How do you turn a $7 figure Perm Total loss to $60K instead? Try Social Media.

The claimant pictured below (identity scrambled for security purposes) sustained moderately severe objective injuries to his back. The benevolent carrier administrating his claim paid wage benefits FOR SEVEN YEARS, but unfortunately, this person filed for perm total benefits anyway. Being a decades-long employee, perm total benefits, if awarded, would be valued in the solid seven figure range.

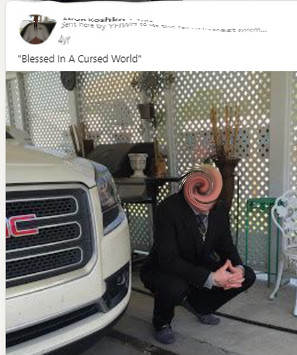

Two weeks before the perm total hearing, the carrier made a social media assignment to Fraud Sniffr in an effort to try to mitigate the damages. The picture you see below was posted about four years after the injury, showing the claimant comfortably posing in a full squat.

When this photo was presented at the pre-trial settlement conference, the claimant lost all interest in proceeding to hearing and settled his case for a final C&R in the amount of $60,000.

What did we learn here? Three Takeaways:

FIRST – Assign social media investigations early. Had a social media investigation been assigned shortly after the DOI the case had the potential to resolve for a fraction of what was actually paid.

SECOND – Update social media often. You never know when a new post will appear that will change the entire trajectory of the claim. At Fraud Sniffr, updates on active social media profiles are unlimited and free for the life of the claim. It costs you nothing to keep tabs on your claimant and results populate, organized chronologically sometimes in as little as 10 minutes.

THIRD – Remember, good investigation paired with excellent defense counsel often produces results you never dared hope for.

For those of you who are still reluctant to spend money on a vendor, consider this: For the money saved on this one claim, this carrier can now do 3000 more social media investigations and still be money ahead. Given the fact that Fraud Sniffr investigations reveal information that is relevant at settlement 60% of the time, the savings only continue.